- This quote won't affect your credit score

- Dedicated Business Finance Specialist

- Get access to 120+ lenders

Start your journey

Features and benefits through Funding Options:

We compare 120+ lenders from across the lending market

Expert help throughout the process from one of our Business Finance Specialists

It is free and doesn’t affect your credit score

It takes minutes to apply, there’s no obligation, and it’s easy to use

Loans from £1000 to £20M

Business Loans - How do they work?

Business loans fall into two categories: secured and unsecured - you’ll be required to offer security for a secured loan whereas unsecured lenders may sometimes ask for a personal guarantee.

Interest rates vary and will depend on your business profile; usually the higher the risk to the lender, the higher the cost of repaying the finance. The lender will assess your business based on a number of factors including your credit rating or if you have any outstanding CCJs when making a decision.

You could be eligible for a business loan of anywhere between £1,000 and £20M, depending on the individual lender as well as your own business’ needs and circumstances.

Before you apply for a business loan, it is important to have the following information to hand: your business plan, business bank statements, profits and losses, your business’ balance sheet and your personal details.

What products are available?

There are many facilities and alternative finance products available on the market that might be right for your business. We work with 120+ lenders offering the widest selection of alternative finance products available, including:

Unsecured Business Loans - finance of up to £750,000 for businesses that don’t own many assets, don’t want to offer security or need finance quickly.

Recovery Loan Scheme (RLS) - government-backed loans from £1,000 to £10M available to businesses of all sizes with no turnover cap. The RLS is delivered through four finance types: Term Loans, Overdrafts, Invoice Finance and Asset Finance. The scheme is set to run from 6th April to 31st December 2021.

Revolving Credit Facilities - pre-approved funds with a rolling agreement. A good alternative to business overdrafts and often more accessible.

Merchant Cash Advance - finance is advanced against payments received via your card terminal. It's perfect for SMEs with few assets but with a significant percentage of takings received through card transactions.

Asset Finance - finance for business assets, e.g. equipment and vehicles. Also enables you to release cash from the value in assets you already own.

Secured Business Loans - loans based on the assets owned by your business. These loans are suitable for businesses that own assets like commercial property, vehicles and machinery, or company directors that don’t want to offer a personal guarantee.

Property Finance - designed for property investors and businesses that need to ‘bridge a gap’ in finance. Bridging finance allows landlords and property developers to purchase a property before selling their existing asset.

Invoice Finance - if you regularly invoice as part of your businesses, you could be eligible for invoice finance — one of the best ways to ease cash flow problems and get paid faster for completed work.

eCommerce Finance - if you do business online, and are looking to grow your inventory or invest in your online presence, this could be the right finance to fuel the growth of your online business venture.

Structured Finance - use this finance to facilitate the sale and purchase of a company you are acquiring. There are a few types of Structured Finance options which include Management Buyout (MBO), Management Buyin (MBI), Leveraged Buyout/Buyin and Acquisition Finance.

How does it work?

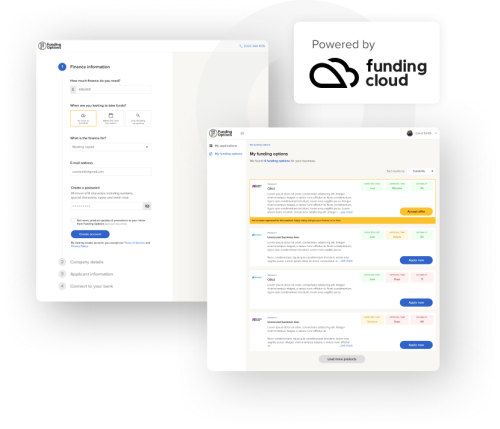

We break down funding barriers with a simple application process that empowers you. Our technology, Funding Cloud, accurately validates your business profile, matching you to the industry’s largest lender network. Funding results are uniquely tailored to each and every business.

Tell us how much you need

Tell us how much you need to borrow, what it's for and provide some basic information about your business.

Get an instant comparison

Our smart technology will compare up to 120+ lenders and match you with the right finance options for your needs.

Apply and get your funding

We'll help you through the process from application to receiving your funds.

Our products

Click below to find out more about each of our products

Business Loans

Invoice Finance

Asset Finance

Property Finance

Commercial Mortgages

Working Capital

Business Cards

Financial product information

Representative example*

7.63% APR Representative based on a loan of £50,000 repayable over 24 months. Monthly repayment of £2,252.94. The total amount payable is £54,070.56

*Some lenders may apply fees during the application process, please note that these are set and provided by these entities.

Annual Percentage Rate

Rates from 2.75% APR

Repayment period

1 month to 30 years terms